Introduction

Are you looking to expand your financial advisory business and connect with a broader audience? Would you like to exhibit your knowledge, reliability, and unique selling point to your ideal customers? Are you interested in increasing your services’ leads, conversions, and referrals?

If you answered yes to any of these questions, you must use Facebook ads.

Using Facebook Ads is a highly effective approach to marketing your financial services and engaging your target audience. Facebook is the largest social media platform globally, with over 2.8 billion monthly active users. It boasts several ad formats, targeting options, and analytics tools that can support you in achieving your marketing goals.

Utilizing Facebook ads for financial advisors is complex and requires extensive research, planning, and optimization to yield optimal results. Simply creating an ad will not suffice, as it is crucial to understand how to

- Define your target audience and create buyer personas.

- Choose the correct type of ad for your objective and budget.

- Create compelling ad copy and images that grab attention and generate interest.

- Set up your landing page and lead magnet to convert visitors into leads.

- Track and optimize your ad performance and ROI.

If you want to learn or improve your skills in creating and running successful Facebook ads, especially for financial advisors, you’ve come to the right place. In this blog post, you’ll discover the best practices, tips, and tricks to achieve your goals and grow your business. With Facebook ads, you can attract, engage, and convert your prospects into clients.

Related Blog: The Ultimate Facebook Ads Conversion Guide for Beginners

So, are you ready to take your business to new heights with Facebook ads? Let’s start and make it happen if the answer is a definite yes!

Uncover Step-By-Step A Systematic And Precise Facebook Marketing Plan

- Building a Customer or Buyer Persona

- Conduct Research Using a Keyword Research Tool

- Stay Up-to-Date with Trending News and Inject Relevant Content

- Organize Your Facebook Posts for Consistency

- Create a Comprehensive Content Calendar

- Utilize Best Practices in Facebook Copywriting

- Harness the Power of Visual Designs

- Attract and Nurture Leads on Facebook

- Measure Your Success through Analytics

- Cultivate a Loyal Online Community

-

Building a Customer or Buyer Persona

To successfully connect with your potential investors or financial clients on Facebook, it is crucial to have a clear understanding of their characteristics. Creating a customer avatar or profile that accurately describes your target audience is helpful. Consider their demographics, psychographics, behaviors, as well as the challenges they encounter (as well as their aspirations).

Additionally, it’s essential to articulate the specific solutions or content that would resonate with your target customers. This level of understanding will enable you to tailor your marketing efforts and provide meaningful value to your audience.

Let’s look at an example of a customer profile that a financial advisor or real estate agent may develop for a potential client. This profile focuses on demographic background, lifestyle, financial/job status, pain points, and online behaviors.

Furthermore, you can use tools like HubSpot’s Make My Person to generate customer avatars. This tool allows you to delve deeper into your prospect’s job, education, demographics, communication methods, financial goals, and challenges.

You’ll be well-equipped to create personalized and effective Facebook marketing strategies by thoroughly understanding your target audience through customer personas.

-

Conduct Research Using a Keyword Research Tool

Once you have identified your target audience and their specific interests and triggers, the next crucial step is to delve deeper into their topics of interest. To accomplish this, employing a keyword research tool can prove immensely valuable.

Two highly effective tools can assist you in this endeavor

-

Ahrefs

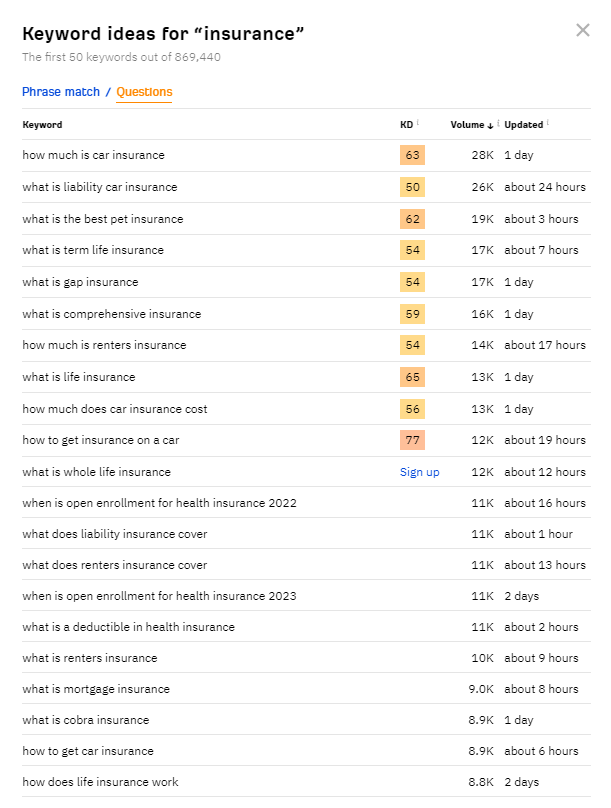

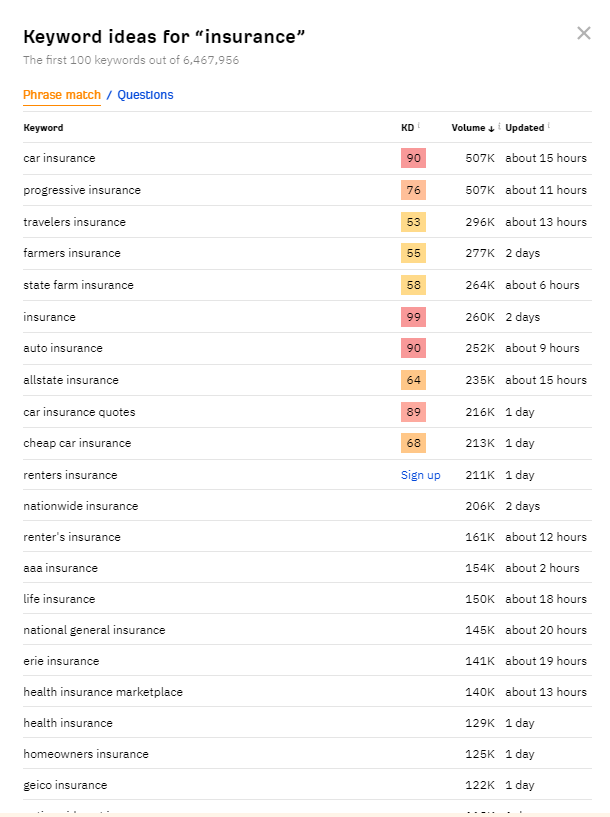

Ahrefs is a comprehensive paid tool that offers several free keyword research features. One such feature is the Keyword Generator Tool, which can be a game-changer for your research. This tool lets you narrow your search to a specific country, providing valuable Keyword Ideas and suggestions.

For instance:

In the example above, the abbreviation “KD” refers to Keyword Difficulty. A lower KD score indicates that achieving a higher ranking for that particular keyword is relatively more straightforward. You can perform searches either based on “Questions” (as demonstrated in the first example) or “Phrase match” (as illustrated in the second example).

-

Answer The Public

Another exceptional tool at your disposal is Answer The Public, which specializes in generating potential questions, also known as long-tail keywords, that align with your prospects’ search queries.

Let’s zoom in on a selection of these commonly queried questions on Google. In this instance, we will focus on “financial planning” in the “English/Singapore” context.

Related Blog: How to Find Easy-to-Rank Keywords

By utilizing these powerful tools, you can effectively identify potential keyword topics to prioritize and cater to the needs and interests of your prospects.

-

-

Stay Up-to-Date with Trending News and Inject Relevant Content

While captivating your audience, keeping a finger on the pulse of current trends and news provides valuable financial advice and wealth planning content.

Utilize tools like Google Trends or Twitter Trends to identify what topics are currently hot and popular. Additionally, flipping through local newspapers can offer valuable insights.

Pay attention to news related to your country’s financial and economic landscape. Topics such as the following can pique the interest of your prospects

- Economic trends and job statistics

- Wealth management and financial market news, including stock market performance

- Human interest stories that showcase both positive examples of financially savvy individuals and negative cases of individuals facing financial challenges

- Policies about insurance, investment, and related areas

- Government policies and regulations related to social security or retirement planning, such as mortgage rules and investment guidelines

Related Blog: Powerful Resources & Tools for Writing Quality Content

-

Organize Your Facebook Posts for Consistency

Once you’ve accumulated a list of potential Facebook content ideas, questions, and campaign concepts using the tools mentioned earlier, organizing them into coherent content themes is crucial.

Creating a content framework will enable you to maintain consistency in your Facebook posts while working through your generated content ideas.

There are several effective ways to organize your content

-

By Customer Avatar

Group your content based on your target customer avatars. Rotate your content among these topics based on your target clients, or even create dedicated channels for each avatar.

-

By Broad Categories

Categorize your content according to financial advisory service areas. A simple classification method involves these five broad areas commonly associated with financial planning

- Investments

- Insurance

- Financial Planning and Budgeting

- Financial/Lifestyle Habits

- Current News and Trends.

-

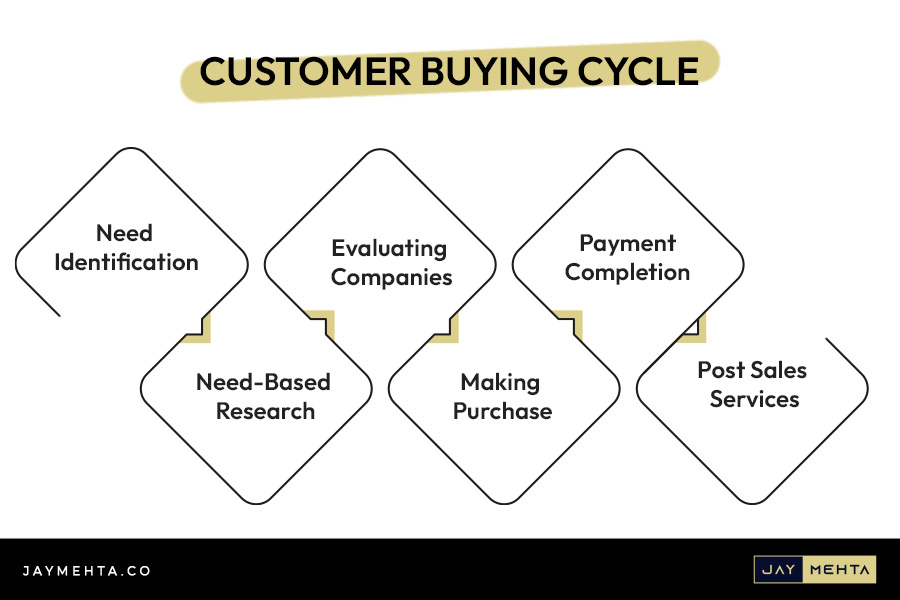

By Customer’s Buying Journey

Map your customer’s buying journey and develop content topic groups that align with each stage.

You can also align your content with your digital marketing funnel stages, from awareness and consideration to conversion and loyalty/advocacy.

Financial advisors can explore various content categories to engage with clients effectively. Here are some examples

-

Awareness

Quick, insightful videos with valuable financial tips, engaging news commentaries, and visually appealing infographics.

-

Consideration

Informative and instructional videos that guide viewers on specific financial topics. Engaging blog articles like “How to pay for a 4-room HDB flat?” can provide valuable insights. Additionally, hosting a series of live sessions on Facebook can help address questions and concerns.

-

Conversion (Lead Generation)

Offer valuable resources like an eBook on financial planning or a budgeting template, available for download after opting in. Conducting Zoom webinars focused on retirement planning can attract potential leads.

-

Conversion (Sales)

Personalized face-to-face consultations tailored to the individual’s financial goals and needs. Financial coaching sessions can also provide valuable guidance for clients.

-

Loyalty/Advocacy

Showcase satisfied customers through testimonials, success stories, and anonymized case studies. This builds loyalty among existing clients and serves as social proof for potential clients.

By diversifying content across these categories, financial advisors can create engaging and valuable resources catering to different client journey stages.

Read also Diversifying Your Marketing Strategies

-

-

Create a Comprehensive Content Calendar

Once you have established the main pillars of your content, it’s time to implement them into a content calendar.

The objective is to share valuable content your audience finds beneficial consistently. Consider creating a content calendar similar to one used by a social media marketing agency (like jaymehta.co). Include customer personas, the buying journey/marketing stage, content titles, topics, content formats, channels, and results in one organized spreadsheet. Adapt it to your specific needs and simplify it as necessary.

-

Utilize Best Practices in Facebook Copywriting

Copywriting is a vast subject but plays a crucial role in Facebook marketing. The first one or two lines, along with your visuals, will capture the most attention.

Here are effective ways to engage your audience:

- Focus On Your Customer Persona

- Address Their Pain Points and Concerns

- Use Thought-Provoking Questions

- Ignite Curiosity

- Cite Compelling Facts and Figures

- Mitigate Risks and Uncertainties

- Appeal to Their Aspirations and Desires

-

Harness the Power of Visual Designs

Visuals such as photos, illustrations, and videos are essential to your Facebook marketing strategy. Employ these best practices to maximize their impact:

- Utilize videos whenever possible. Tools like Lumen5, Invideo, and Wave.app can help create simple yet engaging videos.

- Feature individuals in your visuals who resemble your target audience.

- Incorporate text overlays to emphasize key points.

- Consider using animations when appropriate.

- Opt for bright and highly contrasting colors.

- Utilize simple illustrations to convey your message effectively.

-

Attract and Nurture Leads on Facebook

To generate leads from your Facebook marketing efforts, consider running a Facebook Lead Generation campaign.

For those in the financial advisory business, consider creating an enticing lead magnet to encourage prospects to fill out a form. Some examples include

- Webinars on financial management for specific target groups

- eBooks or guides on insurance types

- Templates to assist clients with expense management

- Calculators for wealth management or retirement planning

- Checklists before investing in financial instruments

- Quizzes to help make better financial decisions

- Giveaways such as premiums or prizes

-

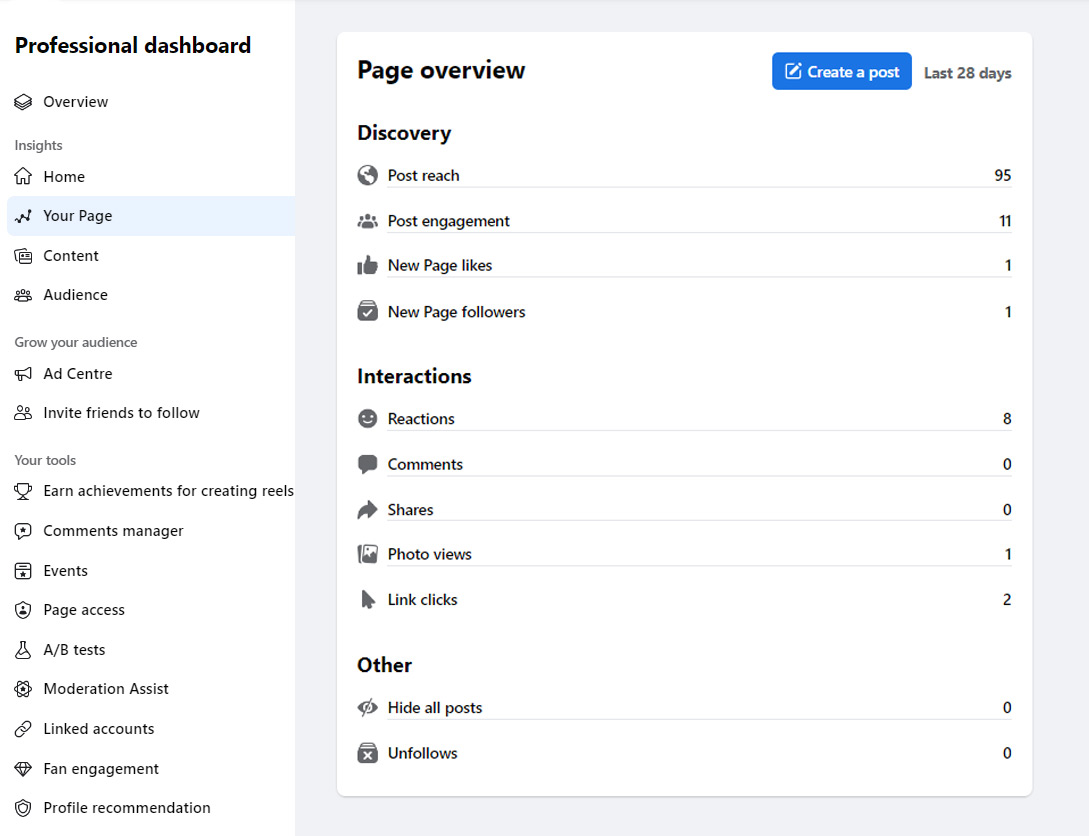

Measure Your Success through Analytics

Measuring your performance is essential to manage your Facebook marketing strategy effectively. Facebook provides various analytics tools to track success across your entire marketing funnel.

-

Facebook Insights

Facebook Insights is a potent tool for individuals seeking to monitor user interactions on their Facebook business page. It is accessible to all the admins of your page and offers a plethora of information about your content and audience.

By utilizing Facebook Insights, you will be able to ascertain the optimal time of day and day of the week to make posts, as well as the most favored content types.

Acknowledging that the Facebook Insights tool undergoes constant updates to reflect your page’s progress and any emerging patterns is essential. Therefore, you will need to keep checking back constantly to stay informed.

-

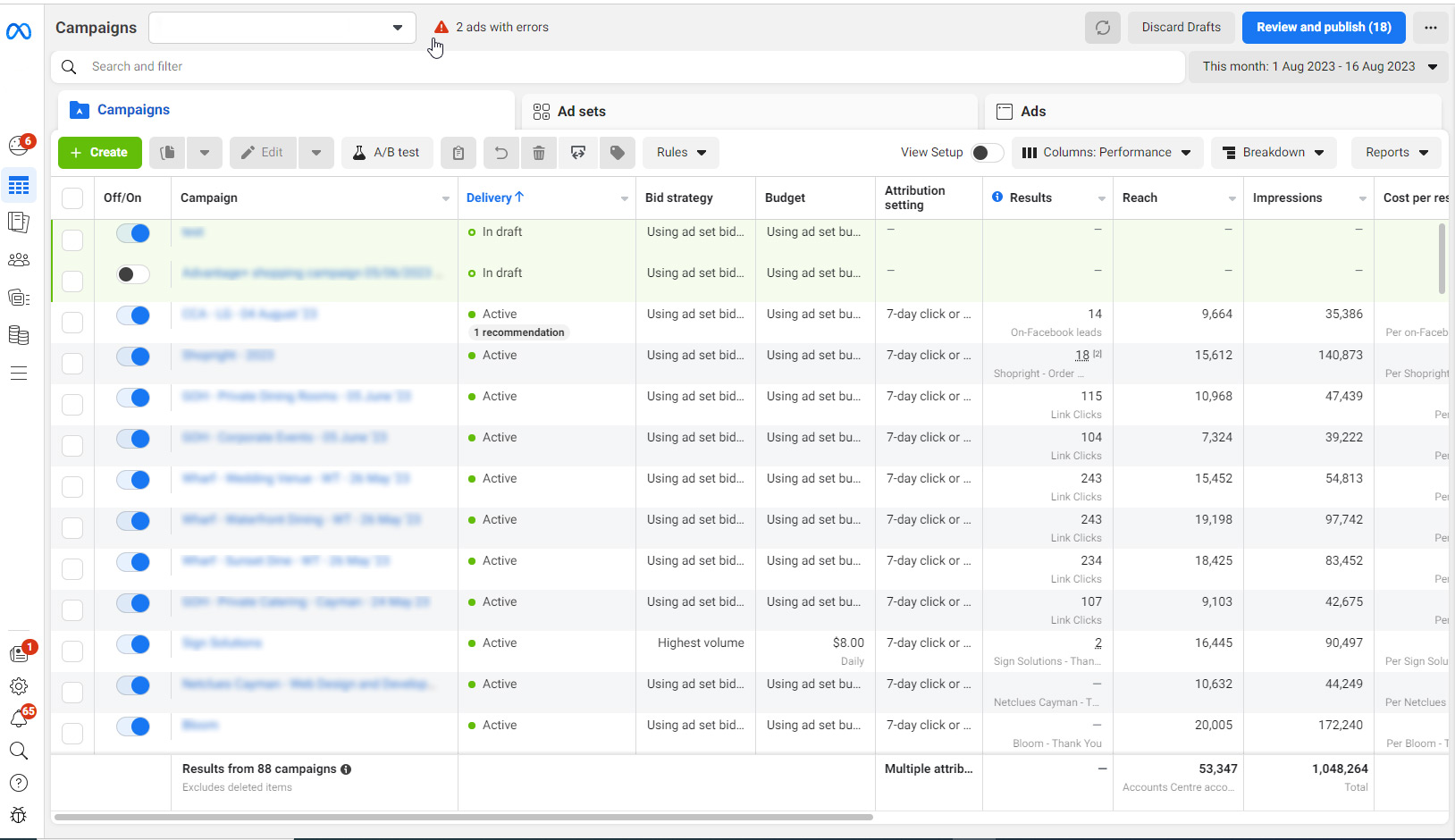

Facebook Ads Manager

This tool provides performance insights for all the ads you’ve run on your page and ad accounts. You can assess Cost Per Results for different campaigns and adjust as needed.

-

-

Cultivate a Loyal Online Community

To build a long-term pipeline of prospects and loyal clients on Facebook, sustaining their interest beyond the initial interaction is crucial. Embrace the following principles of community building:

-

Recruit

Employ various tactics to grow your social media communities.

-

Relate

Engage with community members, fostering a sense of connection and camaraderie.

-

Rejuvenate

Incorporate strategies to sustain and invigorate your community over the long term.

-

Recommend and Refer

Encourage excellent advocacy and referrals among your community members.

These community members can include fans of your Facebook Page or members of a Facebook Group you’ve established.

-

What to Consider when Setting up Facebook Ads for Financial Advisors?

Financial advisors must keep up with this competitive landscape of the digital age by using online advertising and digital marketing strategies for success. Facebook Ads are one of the many platforms available to help them expand their client base and enhance their marketing efforts.

Read also: Digital Marketing Tips For Small Businesses

This platform offers a powerful tool with extensive reach, precise targeting capabilities, and cost-effectiveness. Using Facebook Ads, financial advisors can connect with potential clients and establish a strong brand presence.

-

Understanding the Power of Facebook Ads

Facebook has become integral to people’s lives, with billions of active users worldwide. This vast user base provides an unparalleled reach for financial advisors to showcase their services and expertise. By harnessing Facebook Ads, financial advisors can tap into this massive audience and increase their visibility among potential clients.

Furthermore, the platform’s sophisticated targeting options allow for precise audience segmentation based on demographics, interests, and behaviors. This level of specificity ensures that your ads are delivered to individuals who are most likely to be interested in your financial advisory services, increasing the chances of engagement and conversion.

-

Defining Your Target Audience

Financial advisors can make the most of Facebook Ads to understand their target audience clearly. You can tailor your ad campaigns to resonate with the right individuals by specifying your ideal client persona.

Consider factors such as age, income level, financial goals, and investment preferences to create a detailed profile of your target audience. This knowledge will enable you to craft highly relevant and compelling ad content that speaks directly to their needs, aspirations, and pain points.

-

Setting Clear Campaign Objectives

Before launching any Facebook Ads campaign, it’s essential to establish clear goals and objectives. Financial advisors can have various purposes, such as generating leads, increasing brand awareness, or acquiring new clients.

By defining specific and measurable objectives, you can effectively track the success of your campaigns and evaluate their impact on your business. Clear goals also enable you to refine your strategies and make data-driven decisions to optimize your results.

-

Creating Compelling Ad Content

It’s vital to create compelling ad content to capture the attention of your target audience amidst the noise of social media. Visual elements, such as eye-catching images or videos, can immediately grab the viewer’s attention and convey a sense of professionalism and trustworthiness.

Craft solid and concise headlines that arouse curiosity and encourage users to learn more. Within the ad copy, focus on the unique value proposition of your financial advisory services, highlighting the benefits and solutions you offer.

Consider incorporating educational content, client testimonials, or compelling calls to action to encourage users to take the desired action, whether signing up for a newsletter or scheduling a consultation.

-

Crafting Targeted Ad Campaigns

Facebook provides comprehensive tools and features to help financial advisors create targeted ad campaigns. Leverage the platform’s robust targeting options to reach the right audience for your services. Refine your audience based on demographic factors such as age, location, and income level.

Furthermore, take advantage of Facebook’s detailed interest and behavioral targeting to hone in on individuals who have demonstrated an interest in financial planning, investments, or related topics. By narrowing down your audience, you can ensure that your ads are seen by individuals most likely to engage with your content and become potential clients.

-

Budgeting and Ad Spend

Budgeting is crucial to any successful advertising campaign, including Facebook Ads. Determine an appropriate ad spend based on your marketing objectives and financial resources. Start with a conservative budget and closely monitor the performance of your campaigns.

Facebook’s Ads Manager provides comprehensive analytics and reporting tools to track the effectiveness of your ads. You can optimize your ad spend to maximize return on investment (ROI) and allocate your budget by analyzing key metrics such as click-through rates, conversion rates, and cost per lead.

-

Monitoring and Analyzing Campaign Performance

Continuously monitoring and analyzing the performance of your Facebook Ads campaigns is vital for ongoing optimization. Facebook’s Ads Manager offers a wealth of data and insights that can help you understand the effectiveness of your ads and make informed decisions.

Keep a close eye on key performance indicators such as click-through, engagement, conversion, and cost per acquisition. By tracking these metrics, you can identify trends, spot areas for improvement, and make data-backed adjustments to your campaigns.

The regular analysis allows you to refine your targeting, optimize your ad content, and allocate your budget more efficiently, resulting in improved campaign performance and a better return on your advertising investment.

-

Compliance and Regulatory Considerations

As a financial advisor, navigating the compliance and regulatory considerations associated with advertising, even on social media platforms like Facebook, is crucial. Familiarize yourself with the guidelines and regulations specific to your industry, ensuring that your Facebook Ads align with the required standards.

Avoid making false claims or providing misleading information. Transparency and ethical practices are essential in maintaining the trust and confidence of potential clients. Always prioritize your audience’s best interests and ensure your ads comply with regulatory frameworks.

Read also How to Create a Content Marketing Strategy

Benefits of Facebook Advertising for Financial Adviors

In the realm of advertising, having a well-defined target market or niche is crucial. With its extensive user demographic data, Facebook offers financial advisors a powerful platform to reach their intended audience effectively. With higher click-through rates than Instagram and Audience Network, Facebook ads can engage users, generate leads, and drive conversions for businesses.

-

Easy Ad Creation

Facebook provides user-friendly tools that enable financial advisors to create various ads, such as promoting posts, websites, entire pages, specific posts, or call-to-action buttons. This flexibility empowers advisors to tailor their ads to particular objectives.

-

Lead Generation:

Facebook ads are beneficial for generating leads from individuals who show potential interest in financial advisory services. By gradually exposing potential clients to a brand through ads, financial advisors can cultivate interest and increase the likelihood of conversions.

-

Brand Awareness and Conversions

Facebook helps build brand awareness by familiarizing prospective clients with financial advisory services. As clients become aware of the brand, they may eventually take the step to book an appointment and inquire about services, leading to conversions.

Related Blog: How to Create a Brand Strategy Plan

-

Cost-Effectiveness

Unlike traditional advertising methods like TV ads, mailing campaigns, or billboards, Facebook ads offer a relatively inexpensive alternative. With a vast daily audience, financial advisors can achieve broad reach at a fraction of the cost.

-

Targeted Advertising

Facebook’s ability to target specific demographics ensures that ads reach individuals most likely to benefit from financial advisory services. This targeted approach maximizes exposure while minimizing costs, as ads are seen only by those who may be interested.

-

Enhanced Engagement with Creative Ad Options:

Facebook offers diverse creative and interactive ad formats, including images, slideshows, carousels, collections, canvases, videos, and GIFs. Engaging content is vital to capture users’ attention and effectively promote financial advisory brands.

-

Measurable Success

Facebook provides comprehensive metrics to measure the success of ad campaigns. These insights allow financial advisors to make data-driven adjustments and optimize their advertising strategies for better results.

How Financial Advisors Can Harness the Power of Facebook Ads

Financial advisors can leverage Facebook ads to boost brand exposure and drive conversions. However, two critical factors require careful consideration to maximize the effectiveness of these ads.

-

Ad Frequency

The average number of times users see an ad is a vital consideration. While it may seem logical to expose users to an ad repeatedly, excessive exposure can lead to annoyance and prompt users to hide or react negatively to the ad. In Facebook advertising, an ideal ad frequency of 1 to 2 ensures impactful impressions without overwhelming users.

-

Target Audience

Defining the target audience is essential for optimizing ad impressions and ensuring the ad reaches the right people. Facebook’s targeting options based on location, behavior, demographics, connections, and interests allow financial advisors to refine their audience and tailor their ads accordingly.

By narrowing down the target audience, financial advisors can increase the relevance and effectiveness of their Facebook ads.

Facebook advertising offers significant advantages for financial advisors seeking to reach their target audience, generate leads, and drive conversions. Financial advisors can achieve brand exposure and measurable success by utilizing the platform’s user-friendly ad creation tools, targeting capabilities, cost-effectiveness, and engaging ad formats.

Financial advisors can optimize their Facebook ad campaigns and stay ahead of the competition by carefully considering factors such as ad frequency and target audience.

You May Find Interesting How a Digital Marketing Consultant Can Help You Build a Strong Online Brand

Wrapping Up

What are the next steps? Utilizing Facebook ads can be an effective method for generating leads for your financial advisor business. However, to ensure the success of your ad campaign, it is crucial to invest adequate time and effort into careful planning and execution. Utilize the recommendations provided in this article to create a powerful Facebook ad campaign tailored to your business.

If you require assistance generating more leads and converting them into clients, we invite you to watch our complimentary training video designed specifically for financial advisors. While this training can benefit any business that relies on appointments to secure clients, we have a wealth of experience in delivering exceptional results for financial advisors.

Feeling overwhelmed by the process? Consult with a specialist.

When considering Facebook Advertising for financial advisors, numerous factors exist. Recognizing that you likely have many responsibilities, why not entrust jaymehta.co with your advertising needs? By doing so, you can dedicate your focus to providing exceptional client assistance.

To learn more about our digital marketing services tailored to financial advisors or to address any inquiries, please do not hesitate to contact Jay Mehta!